No doubt, 2023 and 2024 would go down in history as one of Nigeria’s most turbulent years on multiple front: exchange rate crisis, inflationary pressure, and other macroeconomic indices going south. But the most puzzling is the continuous downward tumbling of the value of the naira since the devaluation announcement by the PBAT administration at the assumption of office in May, 2023. In July 2023, the Central Bank authority- under the leadership of Folashodun Shonubi- announced the collapse of all foreign exchange (FX) segments into the Investors and Exporters (I&E) windows and the re-introduction of “willing-buyer-willing-seller” models amongst other rafts of FX reforms.

The announcement in its basic terms implied the shifting of gears in Nigeria’s FX management system to “crawling peg”- which better reflect the twin dynamic of demand and supply- than the “managed float” system previously holding sway in the nation. On the heel of this development, the CBN official FX rate fell by 29% on June 14, 2023 to N660.04 per dollar narrowing the gap between official rate and parallel market rate by N92.00 from N283.33 the day prior. By June ending 2023, the differential between the official and parallel market rate has shrunk to N2.75- a level last seen pre-pandemic era.

The Naira, Nigeria’s national currency, has been at the center of economic debate for years due to its persistent depreciation. To salvage the situation, the CBN activated myriads of well-coordinated demand and supply side policies since the turn of the year. In the similar vein, several reforms have been initiated- even though yet to be fully implemented- by the fiscal authorities, are also aimed at stabilizing the currency. Yet, the question remains: are these measures enough to signal a turning point, or is the battle for the value of the Naira far from over? Put in another word: is stabilizing the value of the naira amidst the threat of the value thief been achieved or are there potential silver linings in the envisioned future trajectory of the Naira?

Causes of the Naira Decline

The Naira, once an envy of other nations, has experience significant decline in recent years with its value tumbling and plummeting to record levels, leading to increased inflation, reduced purchasing power, and economic uncertainty. As the lifeblood of the country’s financial system, the stability of the Naira is crucial for economic growth, trade, and overall prosperity. However, a combination of factors—including overreliance on oil revenues, inconsistent fiscal policies, and global economic pressures—has led to its continued weakening. Moreso, the economy has been characterised with mismanagement, corruption, inefficiencies, and deliberate intent to batter the physical and face value of the currency by Nigerians occasioned by spraying at parties, marching on the currency and deliberate hoarding of newly minted notes for rent-seeking motives.

Tellingly, Nigeria’s economy has long been heavily dependent on crude oil exports, with oil accounting for over 90% of the country’s foreign exchange earnings. This overreliance has made the economy and the Naira highly susceptible to global oil price fluctuations. When oil prices are high, Nigeria’s foreign reserves increase, stabilizing the Naira. However, during periods of oil price crashes—such as the global oil slump in 2014, the pandemic-induced crash in 2020, and the geo-political uncertainties triggered from Europe and Middle East in 2021 and 2023—the country’s earnings drastically decline, resulting in forex shortages and putting immense pressure on the Naira.

In the similar vein, Naira’s depreciation has been attributed to the chronic scarcity of FOREX. Successive administrations have struggled to maintain a steady supply of dollars, euros, and other major currencies, which are vital for imports and foreign investment. The CBN has implemented various measures, including multiple exchange rates and capital controls, to address forex shortages. However, policy mismanagement—such as delayed responses to economic crises and a lack of coherence in currency regulation—has exacerbated the problem, further devaluing the Naira in both the official and parallel markets.

Finally, inflationary pressures and mounting external debt profiles have contributed to significantly to the declining value of the naira. Persistent inflation, occasioned by climbing food prices, sky-rocketing energy cost, and currency floatation, has eroded the purchasing power of the naira. As of 2023, Nigeria’s external debt reached unprecedented levels, necessitating large-scale foreign currency repayments, further straining the country’s foreign reserves and fueling Naira depreciation.

These historical factors have collectively shaped the Naira’s downward trajectory, making its recovery a critical priority in Nigeria’s economic reform agenda.

Approaches to strengthening the value of the Naira

However, more than a year since PBAT rolled outs its raft of reforms, the naira, and by extension the economy, is yet to turn a corner. On the one hand, the slack in the progress can be attributed to natural time lag required for policy reforms to take effect, while on the other hand are the weak institutional capacity together with economic sabotage tendencies of many Nigerians undermining whatever efforts are being made to stabilize and strengthening the value of the national asset.

But crucially, the delay that greeted the appointment of cabinet members- as it took the President circa 90days to form his cabinet- coupled with the fuzzy communication tilt of Mr. Cardoso’s stand in the first two months of his tenure capitulated the FX market into overdrive- with speculative activities permeating the market. More specifically, the official and parallel market rates which close the month of June at N762.9/US$ & N772/US$ respectively weakened to N813.67/US$ and N1150/US$ (differential: average of N336.33) by November 23 2023, a day before the announcement of monetary policy reset by Mr. Olayemi Cardoso. By the time, the Cardoso-led Monetary Policy Committee (MPC) would convene for its two-day first meeting in February 25-26, 2024, the rate had weakened to record levels of N1665.50 and N1830.00 respectively. Additional pressure points on the FX dynamics and by extension Nigeria FX reserves are attributable to dwindling total direct remittance inflow (Q1’2024: US$ 282.6 Vs Q4’ 2023: US$301.3m), low oil production level (Q2’2023: 1.7mbpd vs 1.53mbpd in Q1’2023), settlement of FX backlogs (with about US$7.0 settled between November 2024 and August, 2024) and stagnated foreign investment flow (Q4’2023: US$1.7bn as against US$2.2 in Q4’2022).

BDI Commentaries: Solutions and Strategies

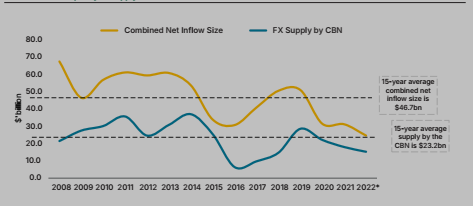

While we commend the Central Bank of Nigeria (CBN) for its efforts to address the foreign exchange (FX) crisis, its limited ability to influence supply-side factors remains a critical gap in Nigeria’s FX strategy. Historically, Nigeria’s FX reserves have heavily relied on net inflows from crude oil and gas exports, along with remittances and portfolio investments. However, since the decline in oil and gas revenues in 2015, the CBN’s capacity to adequately supply the FX market has diminished. Furthermore, the implementation of fiscal policies aimed at enhancing local production—particularly for non-oil exports—has been subpar, leading to a persistent increase in demand for imported goods and services.

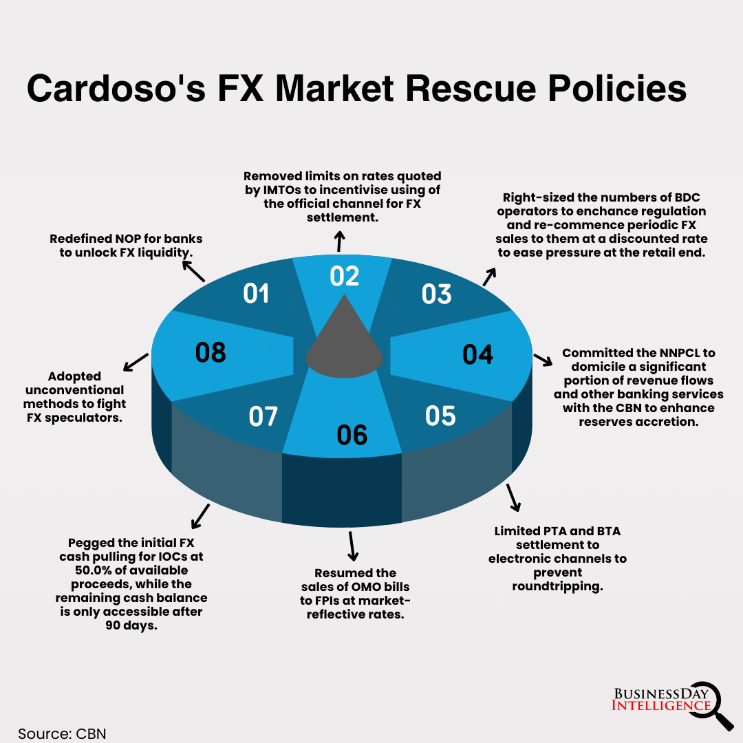

Major policies actions taken by the Cardoso-led CBN, the preliminary impacts, and our insights to optimize future actions are captured in the matrix below:

Cardoso’s FX-policy Blueprint

|

FX House-Keeping |

Key Policy Initiatives since Taking Office | Impact on the economy |

| I. Sustained the policy of the collapse of the previous multiple FX windows into the I&E window and the subsequent transition to the “willing-buyer-willing-seller’ model (NAFEM & NAFEX).

II. Streamlined the number of BDC operators from a staggering sum of more than 7000 to 1500 in January 20924 using the policy of regulatory tightening.

III. Resumed the periodic sale of FX to approved operator at a discounted rate while pegging the mark-up margin to 1.5%.

IV. Set Net Open Position (NOP) ceiling of 25% for foreign currency (FCY)

V. Suspended the use of (FCY) as a collateral for naira loans.

|

I. What should become a short-term pain of this policy has become endemic, due to FX reserve war chest to adequately meet up with the demand and the deep thirst for import driving dollarisation to unprecedented levels.

II. Compliance by BDC operations has been fully enforced by CBN

III. This (III &IV) supported FX liquidity boost in February 2024 (about US$2.5bn and US$4.0bn was immediately unlocked, given the 24-hour deadline set on January 31) as banks move to realign their positions.

IV. The policy achieved modest result in FX liquidity boost as all parties involved were enforced to realign their activities starting July 10, 2024.

|

Tellingly, we have seen that standalone, the policies (i-v) above have only delivered short-term relief on FX debacle. The market has hovered between N1600 and N1700 on the NAFEM and NAFEX respectively. We advocate that for the FX market to experience sustainable tranquility and calm, first traditional FX sources- such as oil production, remittances, and foreign portfolio investment- must be revitalised by supportive polices such as security of oil assets, elimination of multiple taxation, and incentivizing diaspora to remit through official channels. Others include introduction of a project-tied diaspora bond, improved transparency rating, and elimination of policy impediments in the business environment.

Additionally, potential alternate sources of FX such as sales of fallowed assets, non-oil output and talent export should be given priority attention through appropriate monetary, fiscal and trade policy supports to deliver longer term objectives. For extended short-term relief, we apotheosised the option of bilateral loans, natural-resources tied-loans, debt-for nature swaps, asset concession and financialisation.

We also advised that, henceforth, CBN needed to look at sequencing pattern of policy roll-put. Before CBN embarked on several FX and naira stability reform, a lot of house-keeping needed to have been put forward by the apex authority which would have given the naira-strengthening effort an accelerated flight when it is eventually rolled out.

Lastly, to resolve these ongoing FX crises and defend the face and intrinsic value of the naira, it is imperative to effectively execute fiscal reforms that address key challenges such as insecurity, poor infrastructure, an unfriendly business environment, and a weak legal system. Only by tackling these foundational issues can the CBN hope to achieve sustainable solutions to Nigeria’s FX problems.

Muhammad (PhD in View) is a Senior Research and Data Analyst at BusinessDay Intelligence. He has over seven years of quality analytical experience on issues related to the economy, finance, and human capital development.