A child’s education is one of the most meaningful investments a parent can make for their future. Yet unexpected life events can create financial challenges that threaten those educational dreams. Insurance plays a crucial role in safeguarding your child’s education, ensuring their learning journey stays on track even when life takes an unexpected turn.

Therefore, planning your child’s education with confidence, free of worries that it may be truncated by financial failure, definitely will not be there if adequate insurance is put in place.

Throughout history, parents have faced financial challenges in meeting up with payment of school fees for their children or wards, so addressing this will give relief to parents and enable them have that peace of mind that insurance promises.

In response to these challenges, School Fees Protection Insurance was developed to empower parents to provide their children with uninterrupted education at their desired level and quality, regardless of life’s uncertainties.

School Fees Protection Insurance

School fees protection insurance is designed to cover the cost of your child’s education in the event of unexpected circumstances that could disrupt your ability to pay tuition fees. While most School Fee Protection covers are triggered by the death of a parent, coverage can be extended to include permanent disability and critical illness.

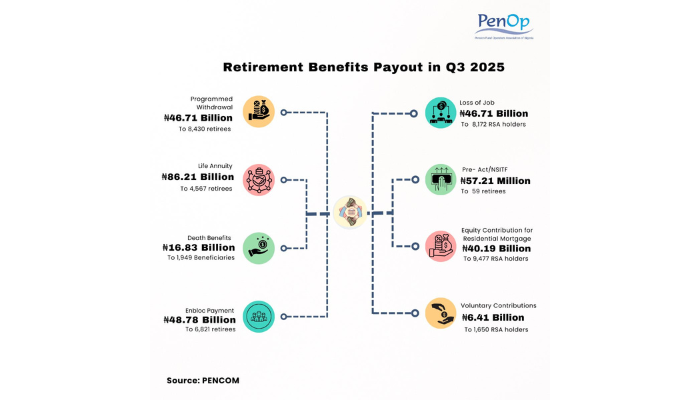

Read also: PenCom forces DBS employers to show annual valuation of pension assets

Generally, School Fees Protection Insurance is designed to provide:

Financial Security: Financial setbacks can happen to anyone at any time. School fees protection insurance provides the financial security to ensure your child’s education is not compromised due to unforeseen financial events.

Uninterrupted Education: Education is a vital aspect of every child’s development. School fees protection insurance ensures that your child’s education will continue without disruption, guaranteeing their future prospects, regardless of how your own prospects may change.

Customizable Coverage: School fees protection insurance generally guarantees the payment of tuition fees in the event parents can no longer afford them. That said, school fee protection policies can be tailored to cover other risks, including disability, illness, and loss of income, for example.

Peace of Mind: Knowing that your child’s education is safeguarded provides the peace of mind to make the best educational choices for your child, regardless of the challenges life may bring.

Flexible Options: For example, Coronation Life Assurance offers a range of off- the-shelf or bespoke school fees protection covers with either annual or one-off payments. This flexibility allows parents with different incomes, cash flows, risks, or educational ambitions to match or build covers that reflect their particular circumstances.

Expert at Coronation Life says its Education Protection Plan ensures the continuation of a child’s education in the event of the death of the parent or guardian named as the sponsor of the child’s education in the policy terms. Offering fixed rates of payments over defined timeframes, the plan includes the following features:

One year minimum policy terms with the option to extend until 65 years of age.

For a one-year cover, any claim in that year pays the child’s school fees until the end of the current level of education.

Premiums are calculated as a function of age, duration, payment frequency, and sum assured.

Flexible payment options: monthly, quarterly, half yearly, annually, or upfront settlement.

Coverage is also available for individuals aged 18 – 64 years for Life and Accidental Permanent Disability cover, and 18 – 59 years for Critical Illness cover.

Pay-out is administered by the nominated guardian, with Coronation also being eligible for nominated as a guardian, and suitable for multiple children at all stages of education.

Option to extend to coverage to include permanent disability and critical illness at an additional premium.

School Fees Protection insurance is not just a practical financial tool, it’s a commitment to your child’s future, providing a safety net that ensures their academic journey continues and their dreams remain within reach.

How to start

Before obtaining school fees protection insurance, it’s essential to evaluate your financial situation, education goals, and potential risks.